Skip Navigation

Articles

July 17, 2025 · Brea Black

Artsy Crafty Library: Unwind with slow stitching

When life gets a little stressful, it’s nice to have a creative way to slow down and relax. Practicing slow stitching allows you to focus solely on making something with your hands.

July 17, 2025 · Brea Black

Artsy Crafty Library: Unwind with slow stitching

When life gets a little stressful, it’s nice to have a creative way to slow down and relax. Practicing slow stitching allows you to focus solely on making something with your hands.

July 17, 2025 · Luanne Webb

Great Read Alouds: Get ready for kindergarten!

Find tips to help young kids get ready to start school and fun books to read together to practice kindergarten skills.

July 17, 2025 · Luanne Webb

Great Read Alouds: Get ready for kindergarten!

Find tips to help young kids get ready to start school and fun books to read together to practice kindergarten skills.

July 14, 2025 · Meg Porteous

A Way Out: Science fiction in a SciFi world

Take our Journey Through the Genres to science fiction. You'll find book recommendations of stories that offer a way out, a way forward and a way through it all.

July 14, 2025 · Meg Porteous

A Way Out: Science fiction in a SciFi world

Take our Journey Through the Genres to science fiction. You'll find book recommendations of stories that offer a way out, a way forward and a way through it all.

July 9, 2025 · Ginger Park

Improving library property

We are improving the parking lot, removing invasive trees, adding optimal trees, and adding more plants for bees, butterflies and other pollinators to support our ecosystem.

July 9, 2025 · Ginger Park

Improving library property

We are improving the parking lot, removing invasive trees, adding optimal trees, and adding more plants for bees, butterflies and other pollinators to support our ecosystem.

July 8, 2025 · Arion Beals

Kid Tested, Librarian Recommended: Fun early chapter books

July 8, 2025 · Arion Beals

Kid Tested, Librarian Recommended: Fun early chapter books

July 3, 2025 · Chris Blocker

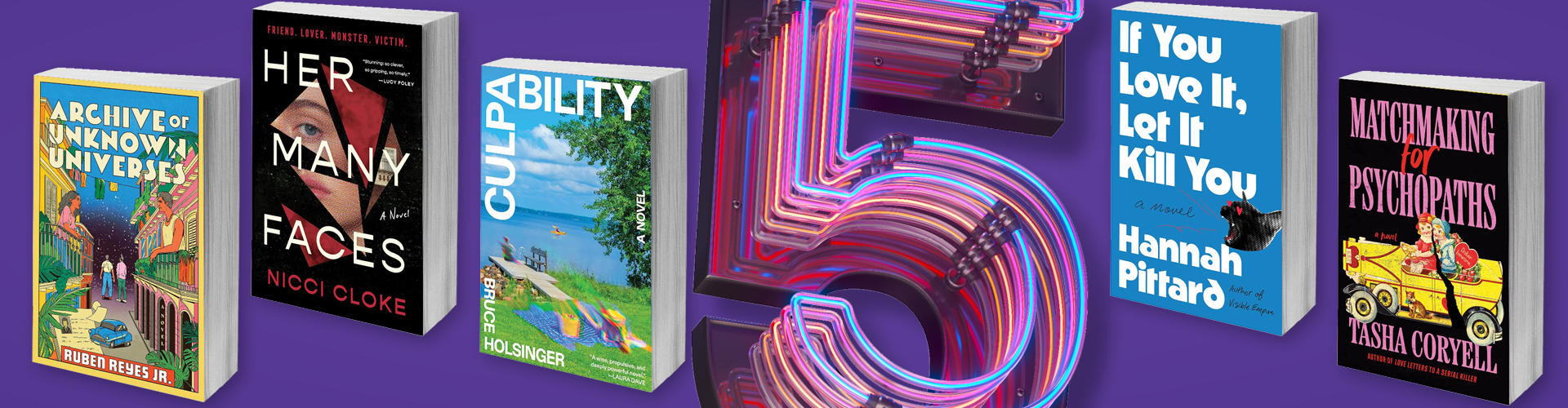

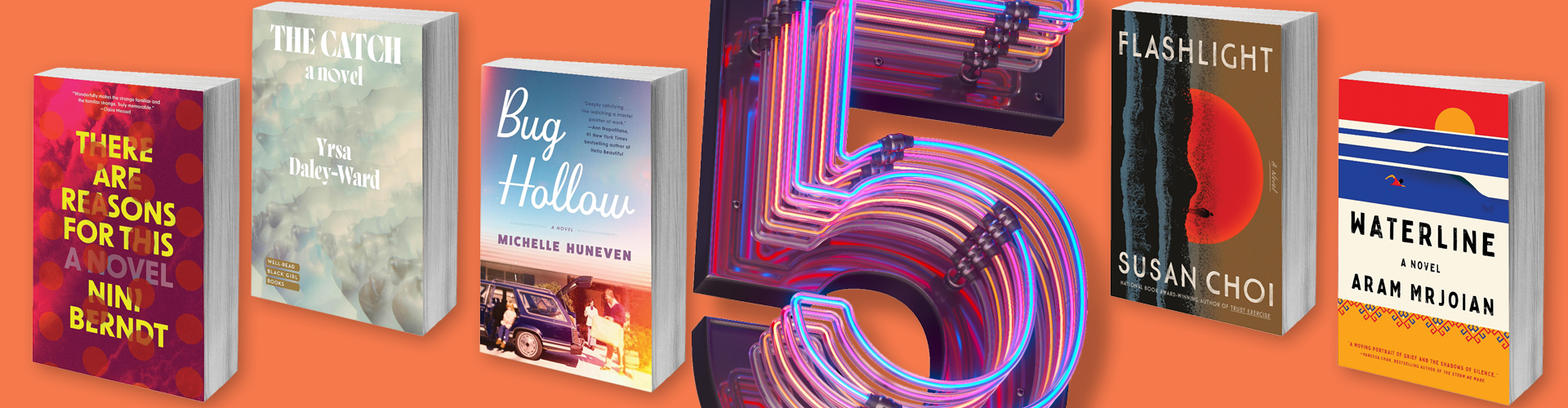

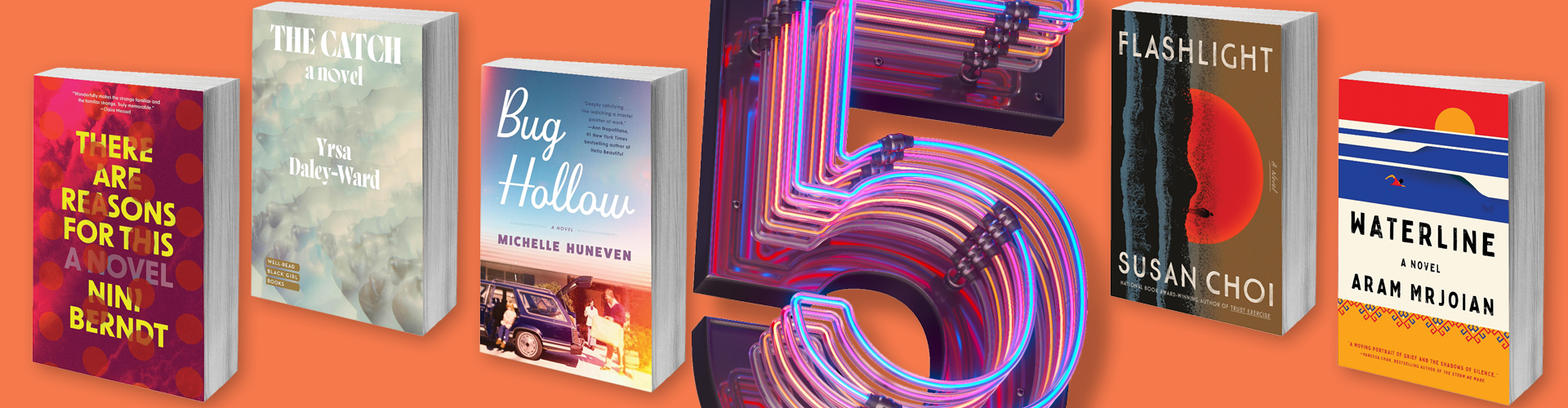

Fiction Five: Hot new releases for summer reading

With dozens of popular new titles releasing every month, it’s easy for some noteworthy books to slip on by. Chris highlights 5 new novels you won't want to miss.

July 3, 2025 · Chris Blocker

Fiction Five: Hot new releases for summer reading

With dozens of popular new titles releasing every month, it’s easy for some noteworthy books to slip on by. Chris highlights 5 new novels you won't want to miss.

July 3, 2025 · Travis Garwood

Artsy Crafty Library: Inexpensive pottery for beginners

Unleash your inner artist and discover the joy of creating something beautiful with your hands. With air dry clay you can try pottery without the huge up-front cost of traditional ceramics.

July 3, 2025 · Travis Garwood

Artsy Crafty Library: Inexpensive pottery for beginners

Unleash your inner artist and discover the joy of creating something beautiful with your hands. With air dry clay you can try pottery without the huge up-front cost of traditional ceramics.

July 3, 2025 · Sherri Camp

Finding your family history in military records

Learn how to use Fold3 to discover the stories of your family members who served in the military. Whether you’re tracing your family history or researching a broader historical period, this is a helpful tool.

July 3, 2025 · Sherri Camp

Finding your family history in military records

Learn how to use Fold3 to discover the stories of your family members who served in the military. Whether you’re tracing your family history or researching a broader historical period, this is a helpful tool.

July 1, 2025 · Julie Nelson

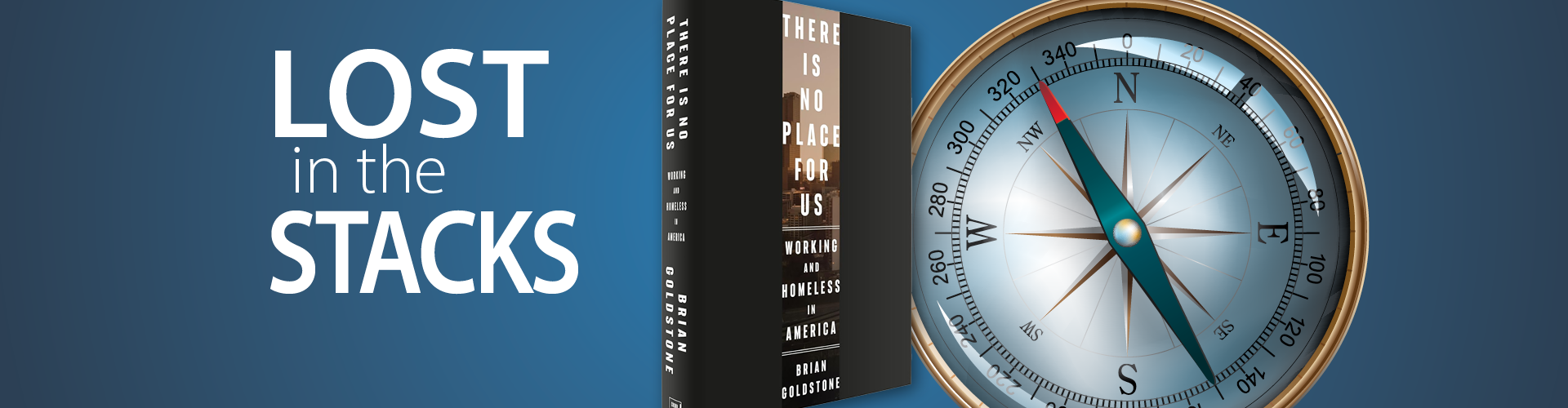

Lost in the Stacks: There Is No Place for Us

Learn about families, squeezed by high rents and low inventory of affordable housing, who were often one paycheck away from being homeless in Brian Goldstone's new nonfiction book.

July 1, 2025 · Julie Nelson

Lost in the Stacks: There Is No Place for Us

Learn about families, squeezed by high rents and low inventory of affordable housing, who were often one paycheck away from being homeless in Brian Goldstone's new nonfiction book.

June 26, 2025 · Kaitlyn Kriley

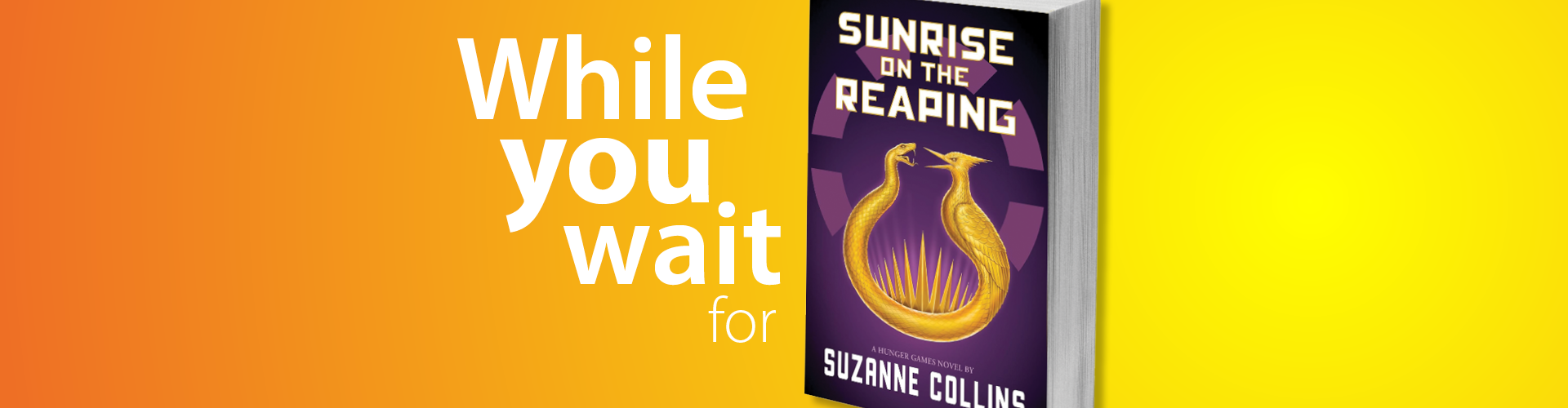

While You Wait for Sunrise on the Reaping

While you wait to dive back into the world of The Hunger Games, we recommend other compelling dystopian novels you should check out.

June 26, 2025 · Kaitlyn Kriley

While You Wait for Sunrise on the Reaping

While you wait to dive back into the world of The Hunger Games, we recommend other compelling dystopian novels you should check out.

June 26, 2025 · Sherry Hess

Early Childhood Tip: Modeling mindfulness

Mindfulness can help alleviate stress for both you and your kids. Being a mindful parent means letting go of the idea that things and/or you need to be perfect.

June 26, 2025 · Sherry Hess

Early Childhood Tip: Modeling mindfulness

Mindfulness can help alleviate stress for both you and your kids. Being a mindful parent means letting go of the idea that things and/or you need to be perfect.

June 25, 2025 · Areli Bermudez-Villarreal

New & upcoming book adaptations to watch

Peek into the best and worst book adaptations and find a list of adaptations to add to your to be watched list.

June 25, 2025 · Areli Bermudez-Villarreal

New & upcoming book adaptations to watch

Peek into the best and worst book adaptations and find a list of adaptations to add to your to be watched list.

June 23, 2025 · Ginger Park

Civic Engagement

The library hosts events & programs that encourage discussion among residents and involvement in local government.

June 23, 2025 · Ginger Park

Civic Engagement

The library hosts events & programs that encourage discussion among residents and involvement in local government.

June 20, 2025 · Abigail Siemers

What YA' Reading: Survival

Check out thrilling young adult books with main characters who are fighting for survival.

June 20, 2025 · Abigail Siemers

What YA' Reading: Survival

Check out thrilling young adult books with main characters who are fighting for survival.

June 19, 2025 · Debbie Reiff

Great Read Alouds: Sibling stories

Discover lovely new picture books that celebrate positive sibling dynamics with a good story.

June 19, 2025 · Debbie Reiff

Great Read Alouds: Sibling stories

Discover lovely new picture books that celebrate positive sibling dynamics with a good story.

June 17, 2025 · Katie Keckeisen

Dr. Samuel Crumbine: Topeka’s public health pioneer

Dr. Crumbine spent his career making Kansans healthier and preventing the spread of deadly diseases. Learn more about Topeka's history.

June 17, 2025 · Katie Keckeisen

Dr. Samuel Crumbine: Topeka’s public health pioneer

Dr. Crumbine spent his career making Kansans healthier and preventing the spread of deadly diseases. Learn more about Topeka's history.

June 15, 2025 · Rachael Schmidtlein

Kid Tested, Librarian Recommended: SciFi

Jump into adventures with fantastic books where kids lead the journeys in amazing science fiction worlds.

June 15, 2025 · Rachael Schmidtlein

Kid Tested, Librarian Recommended: SciFi

Jump into adventures with fantastic books where kids lead the journeys in amazing science fiction worlds.

June 12, 2025 · Julie Nelson

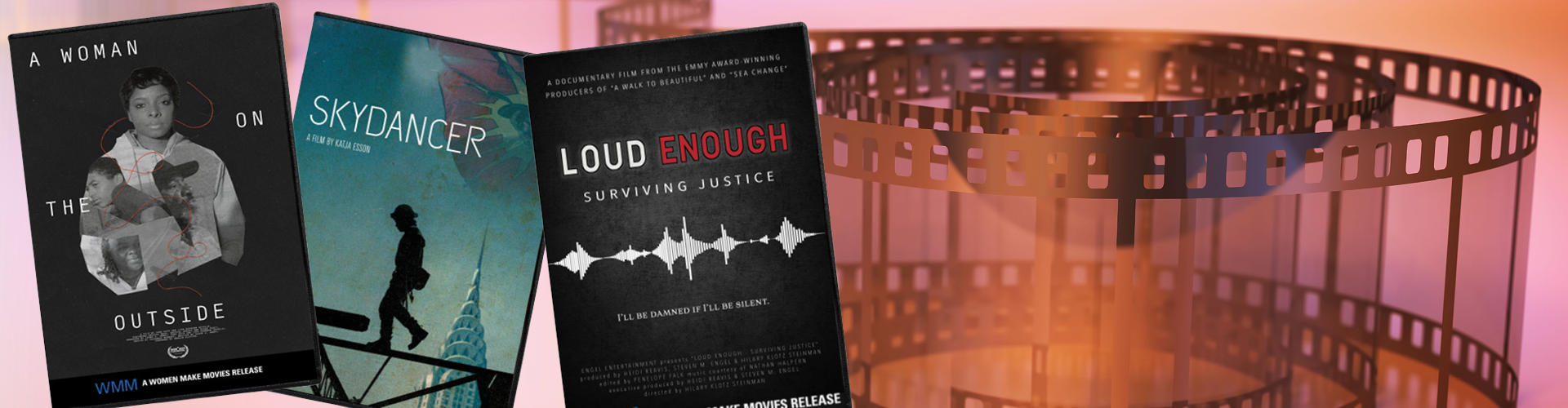

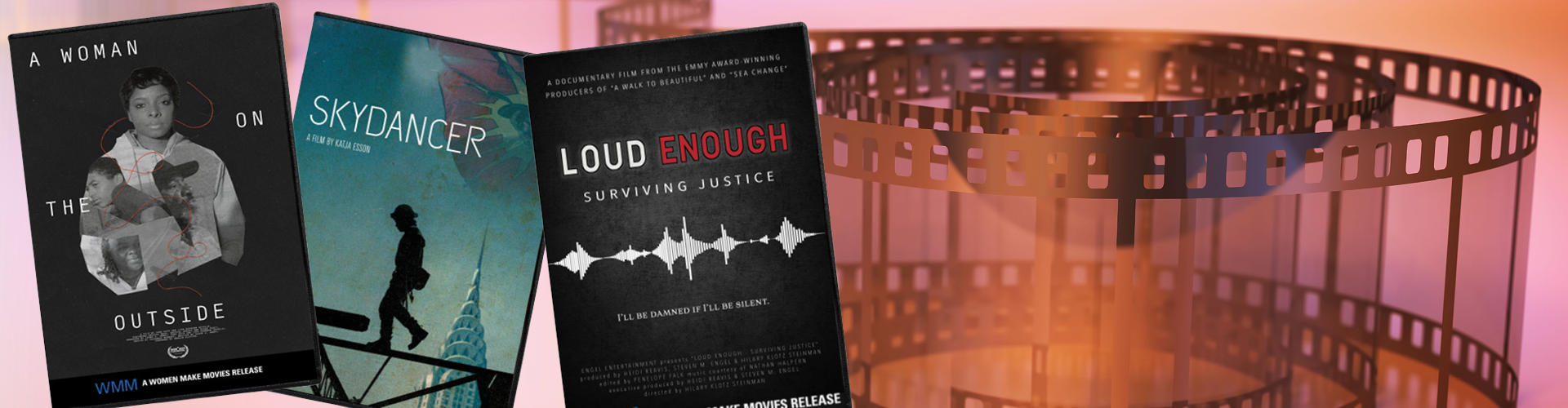

Reel World: Women Make Movies

Discover compelling and award-winning documentaries that elevate and expose women's stories.

June 12, 2025 · Julie Nelson

Reel World: Women Make Movies

Discover compelling and award-winning documentaries that elevate and expose women's stories.

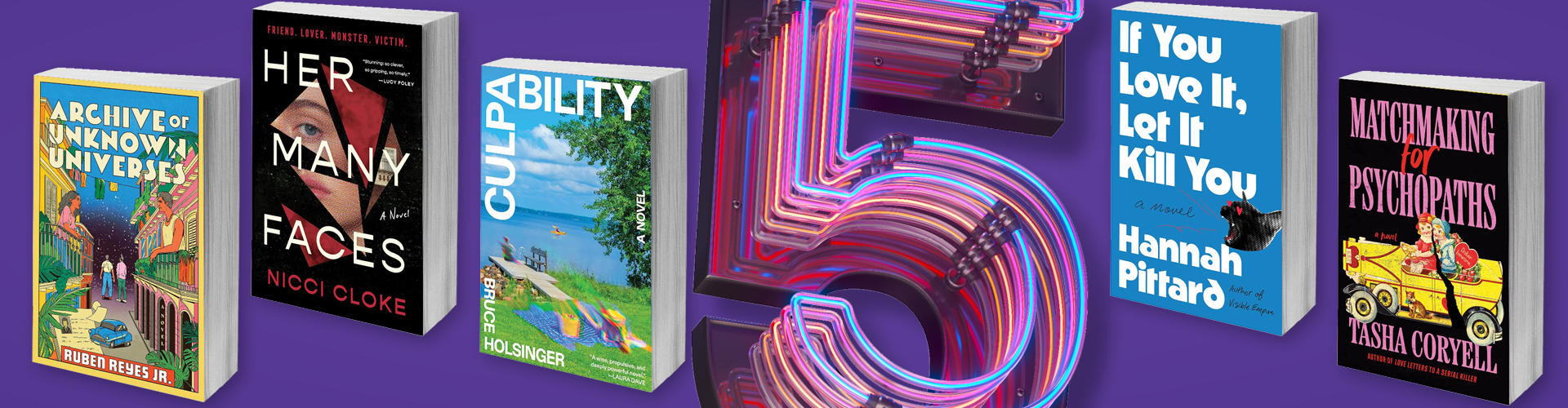

June 5, 2025 · Chris Blocker

Fiction Five: Facing Adversity

This month’s grief-tinged new reads include heartbreak, healing, withdrawal and reconnection, but also some intrigue and a few laughs.

June 5, 2025 · Chris Blocker

Fiction Five: Facing Adversity

This month’s grief-tinged new reads include heartbreak, healing, withdrawal and reconnection, but also some intrigue and a few laughs.

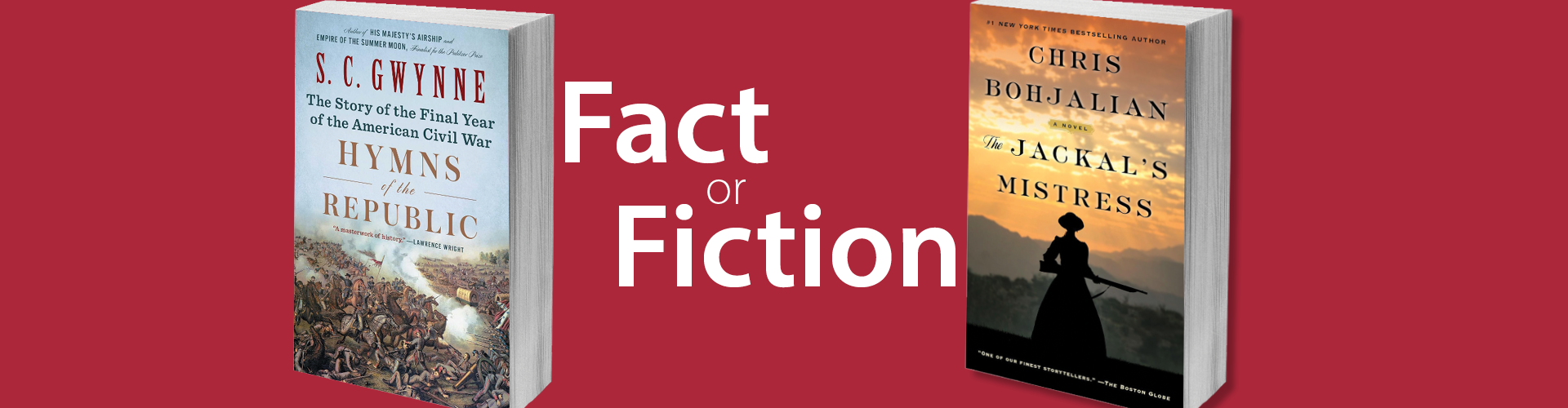

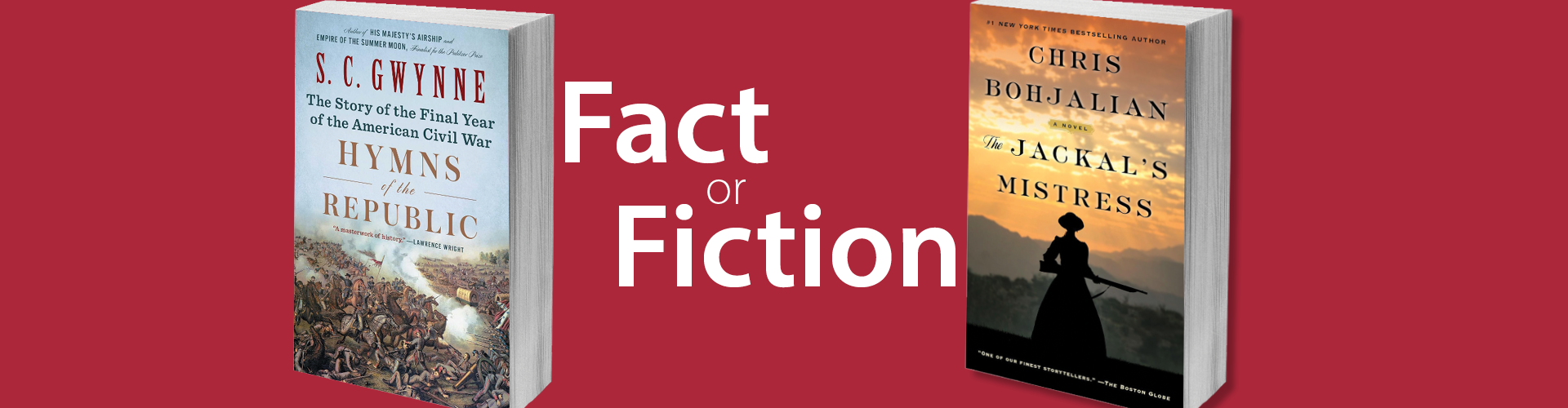

June 4, 2025 · Julie Nelson

Fact or Fiction: The Civil War

Experience the last deadly year of the U.S. Civil War in a history read and historical fiction.

June 4, 2025 · Julie Nelson

Fact or Fiction: The Civil War

Experience the last deadly year of the U.S. Civil War in a history read and historical fiction.

May 30, 2025 · Sherry Hess

Tips to increase your child's vocabulary

Children are excited to learn new words and Sherry helps you work them into your routine.

May 30, 2025 · Sherry Hess

Tips to increase your child's vocabulary

Children are excited to learn new words and Sherry helps you work them into your routine.

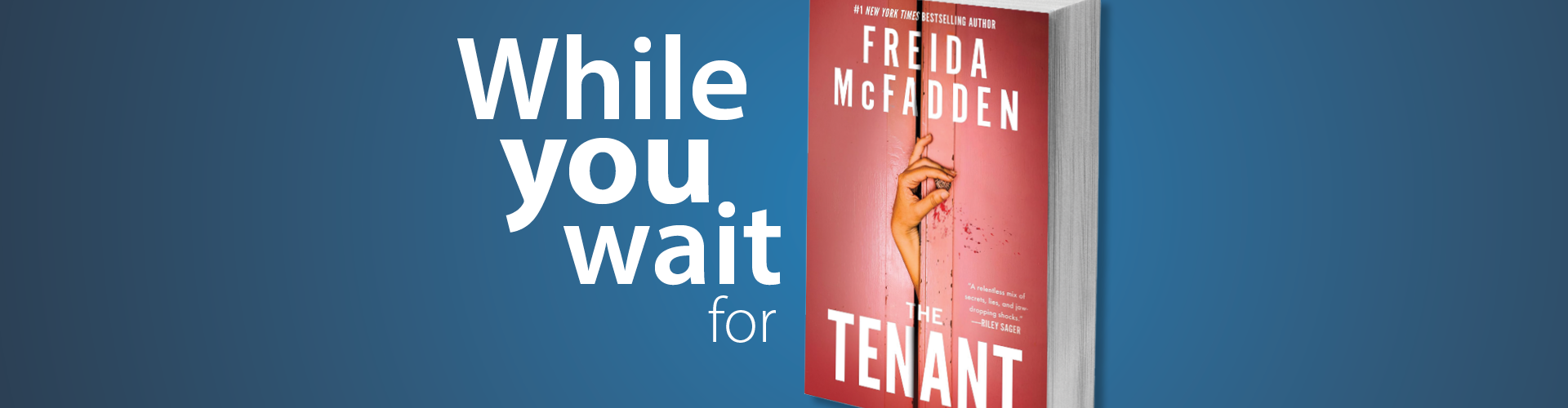

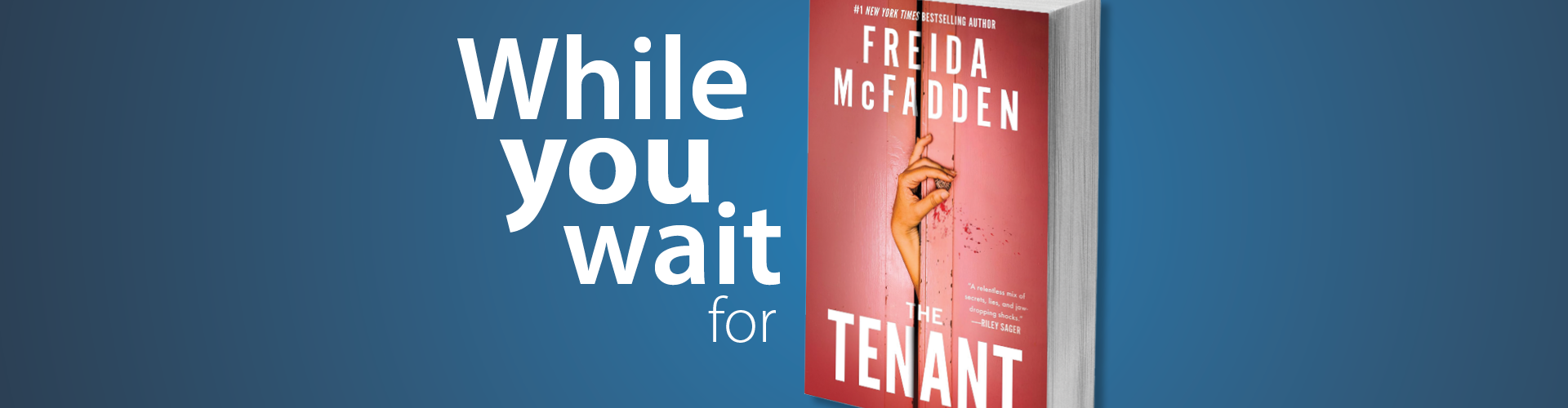

May 28, 2025 · Kaitlyn Kriley

While you wait for The Tenant

We've got reads to keep you busy while you wait for Freida McFadden's latest story, The Tenant. These books will have you questioning it all.

May 28, 2025 · Kaitlyn Kriley

While you wait for The Tenant

We've got reads to keep you busy while you wait for Freida McFadden's latest story, The Tenant. These books will have you questioning it all.

May 28, 2025 · Ginger Park

Master Gardener advice to improve outdoor spaces

Shawnee County Extension Master Gardeners share tips to help you care for mature plants, new plantings, your lawn and the pollinators who support your garden during the summer.

May 28, 2025 · Ginger Park

Master Gardener advice to improve outdoor spaces

Shawnee County Extension Master Gardeners share tips to help you care for mature plants, new plantings, your lawn and the pollinators who support your garden during the summer.

May 28, 2025 · Rain Schultz-Pruner

Great Read Alouds: Summer fun & sunshine

Get ready to read in the sunshine with these wonderful picture books all about summer!

May 28, 2025 · Rain Schultz-Pruner

Great Read Alouds: Summer fun & sunshine

Get ready to read in the sunshine with these wonderful picture books all about summer!

Back to Top

July 17, 2025 · Brea Black

Artsy Crafty Library: Unwind with slow stitching

When life gets a little stressful, it’s nice to have a creative way to slow down and relax. Practicing slow stitching allows you to focus solely on making something with your hands.

July 17, 2025 · Brea Black

Artsy Crafty Library: Unwind with slow stitching

When life gets a little stressful, it’s nice to have a creative way to slow down and relax. Practicing slow stitching allows you to focus solely on making something with your hands.

July 17, 2025 · Luanne Webb

Great Read Alouds: Get ready for kindergarten!

Find tips to help young kids get ready to start school and fun books to read together to practice kindergarten skills.

July 17, 2025 · Luanne Webb

Great Read Alouds: Get ready for kindergarten!

Find tips to help young kids get ready to start school and fun books to read together to practice kindergarten skills.

July 14, 2025 · Meg Porteous

A Way Out: Science fiction in a SciFi world

Take our Journey Through the Genres to science fiction. You'll find book recommendations of stories that offer a way out, a way forward and a way through it all.

July 14, 2025 · Meg Porteous

A Way Out: Science fiction in a SciFi world

Take our Journey Through the Genres to science fiction. You'll find book recommendations of stories that offer a way out, a way forward and a way through it all.

July 9, 2025 · Ginger Park

Improving library property

We are improving the parking lot, removing invasive trees, adding optimal trees, and adding more plants for bees, butterflies and other pollinators to support our ecosystem.

July 9, 2025 · Ginger Park

Improving library property

We are improving the parking lot, removing invasive trees, adding optimal trees, and adding more plants for bees, butterflies and other pollinators to support our ecosystem.

July 8, 2025 · Arion Beals

Kid Tested, Librarian Recommended: Fun early chapter books

July 8, 2025 · Arion Beals

Kid Tested, Librarian Recommended: Fun early chapter books

July 3, 2025 · Chris Blocker

Fiction Five: Hot new releases for summer reading

With dozens of popular new titles releasing every month, it’s easy for some noteworthy books to slip on by. Chris highlights 5 new novels you won't want to miss.

July 3, 2025 · Chris Blocker

Fiction Five: Hot new releases for summer reading

With dozens of popular new titles releasing every month, it’s easy for some noteworthy books to slip on by. Chris highlights 5 new novels you won't want to miss.

July 3, 2025 · Travis Garwood

Artsy Crafty Library: Inexpensive pottery for beginners

Unleash your inner artist and discover the joy of creating something beautiful with your hands. With air dry clay you can try pottery without the huge up-front cost of traditional ceramics.

July 3, 2025 · Travis Garwood

Artsy Crafty Library: Inexpensive pottery for beginners

Unleash your inner artist and discover the joy of creating something beautiful with your hands. With air dry clay you can try pottery without the huge up-front cost of traditional ceramics.

July 3, 2025 · Sherri Camp

Finding your family history in military records

Learn how to use Fold3 to discover the stories of your family members who served in the military. Whether you’re tracing your family history or researching a broader historical period, this is a helpful tool.

July 3, 2025 · Sherri Camp

Finding your family history in military records

Learn how to use Fold3 to discover the stories of your family members who served in the military. Whether you’re tracing your family history or researching a broader historical period, this is a helpful tool.

July 1, 2025 · Julie Nelson

Lost in the Stacks: There Is No Place for Us

Learn about families, squeezed by high rents and low inventory of affordable housing, who were often one paycheck away from being homeless in Brian Goldstone's new nonfiction book.

July 1, 2025 · Julie Nelson

Lost in the Stacks: There Is No Place for Us

Learn about families, squeezed by high rents and low inventory of affordable housing, who were often one paycheck away from being homeless in Brian Goldstone's new nonfiction book.

June 26, 2025 · Kaitlyn Kriley

While You Wait for Sunrise on the Reaping

While you wait to dive back into the world of The Hunger Games, we recommend other compelling dystopian novels you should check out.

June 26, 2025 · Kaitlyn Kriley

While You Wait for Sunrise on the Reaping

While you wait to dive back into the world of The Hunger Games, we recommend other compelling dystopian novels you should check out.

June 26, 2025 · Sherry Hess

Early Childhood Tip: Modeling mindfulness

Mindfulness can help alleviate stress for both you and your kids. Being a mindful parent means letting go of the idea that things and/or you need to be perfect.

June 26, 2025 · Sherry Hess

Early Childhood Tip: Modeling mindfulness

Mindfulness can help alleviate stress for both you and your kids. Being a mindful parent means letting go of the idea that things and/or you need to be perfect.

June 25, 2025 · Areli Bermudez-Villarreal

New & upcoming book adaptations to watch

Peek into the best and worst book adaptations and find a list of adaptations to add to your to be watched list.

June 25, 2025 · Areli Bermudez-Villarreal

New & upcoming book adaptations to watch

Peek into the best and worst book adaptations and find a list of adaptations to add to your to be watched list.

June 23, 2025 · Ginger Park

Civic Engagement

The library hosts events & programs that encourage discussion among residents and involvement in local government.

June 23, 2025 · Ginger Park

Civic Engagement

The library hosts events & programs that encourage discussion among residents and involvement in local government.

June 20, 2025 · Abigail Siemers

What YA' Reading: Survival

Check out thrilling young adult books with main characters who are fighting for survival.

June 20, 2025 · Abigail Siemers

What YA' Reading: Survival

Check out thrilling young adult books with main characters who are fighting for survival.

June 19, 2025 · Debbie Reiff

Great Read Alouds: Sibling stories

Discover lovely new picture books that celebrate positive sibling dynamics with a good story.

June 19, 2025 · Debbie Reiff

Great Read Alouds: Sibling stories

Discover lovely new picture books that celebrate positive sibling dynamics with a good story.

June 17, 2025 · Katie Keckeisen

Dr. Samuel Crumbine: Topeka’s public health pioneer

Dr. Crumbine spent his career making Kansans healthier and preventing the spread of deadly diseases. Learn more about Topeka's history.

June 17, 2025 · Katie Keckeisen

Dr. Samuel Crumbine: Topeka’s public health pioneer

Dr. Crumbine spent his career making Kansans healthier and preventing the spread of deadly diseases. Learn more about Topeka's history.

June 15, 2025 · Rachael Schmidtlein

Kid Tested, Librarian Recommended: SciFi

Jump into adventures with fantastic books where kids lead the journeys in amazing science fiction worlds.

June 15, 2025 · Rachael Schmidtlein

Kid Tested, Librarian Recommended: SciFi

Jump into adventures with fantastic books where kids lead the journeys in amazing science fiction worlds.

June 12, 2025 · Julie Nelson

Reel World: Women Make Movies

Discover compelling and award-winning documentaries that elevate and expose women's stories.

June 12, 2025 · Julie Nelson

Reel World: Women Make Movies

Discover compelling and award-winning documentaries that elevate and expose women's stories.

June 5, 2025 · Chris Blocker

Fiction Five: Facing Adversity

This month’s grief-tinged new reads include heartbreak, healing, withdrawal and reconnection, but also some intrigue and a few laughs.

June 5, 2025 · Chris Blocker

Fiction Five: Facing Adversity

This month’s grief-tinged new reads include heartbreak, healing, withdrawal and reconnection, but also some intrigue and a few laughs.

June 4, 2025 · Julie Nelson

Fact or Fiction: The Civil War

Experience the last deadly year of the U.S. Civil War in a history read and historical fiction.

June 4, 2025 · Julie Nelson

Fact or Fiction: The Civil War

Experience the last deadly year of the U.S. Civil War in a history read and historical fiction.

May 30, 2025 · Sherry Hess

Tips to increase your child's vocabulary

Children are excited to learn new words and Sherry helps you work them into your routine.

May 30, 2025 · Sherry Hess

Tips to increase your child's vocabulary

Children are excited to learn new words and Sherry helps you work them into your routine.

May 28, 2025 · Kaitlyn Kriley

While you wait for The Tenant

We've got reads to keep you busy while you wait for Freida McFadden's latest story, The Tenant. These books will have you questioning it all.

May 28, 2025 · Kaitlyn Kriley

While you wait for The Tenant

We've got reads to keep you busy while you wait for Freida McFadden's latest story, The Tenant. These books will have you questioning it all.

May 28, 2025 · Ginger Park

Master Gardener advice to improve outdoor spaces

Shawnee County Extension Master Gardeners share tips to help you care for mature plants, new plantings, your lawn and the pollinators who support your garden during the summer.

May 28, 2025 · Ginger Park

Master Gardener advice to improve outdoor spaces

Shawnee County Extension Master Gardeners share tips to help you care for mature plants, new plantings, your lawn and the pollinators who support your garden during the summer.

May 28, 2025 · Rain Schultz-Pruner

Great Read Alouds: Summer fun & sunshine

Get ready to read in the sunshine with these wonderful picture books all about summer!

May 28, 2025 · Rain Schultz-Pruner

Great Read Alouds: Summer fun & sunshine

Get ready to read in the sunshine with these wonderful picture books all about summer!